Stay on top of you Expenses

One dashboard for all expenses and purchases—see due dates, manage payables, stay compliant.

Smart Expense Tracking

Watch our 1-min expense guide

Track expense in an instant

Oojeema lets you create bills in minutes, map VAT and withholding correctly, and see real-time payables and due dates at a glance—BIR-ready

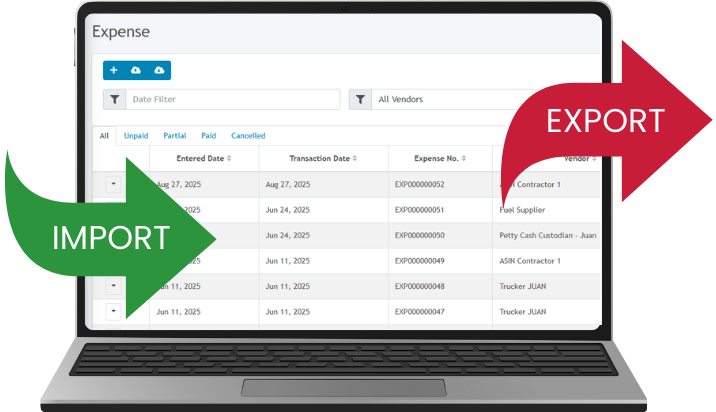

Import & Export data in a snap

With Oojeema, you can import via CSV templates and export clean, BIR-ready reports and listings in clicks.

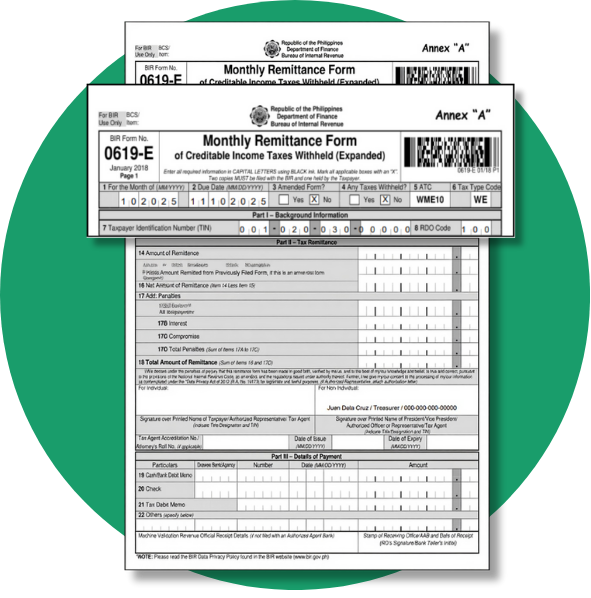

Turn purchases and bills into BIR-ready reports

Oojeema auto – generate BIR forms and reports with the right VAT/EWT from your expenses and purchases—simply Review, Generate, and File.

Print BIR Form 2307 in Minutes

Generate vendor 2307s from your recorded purchases and expenses—with correct EWT details and ready-to-print PDFs.

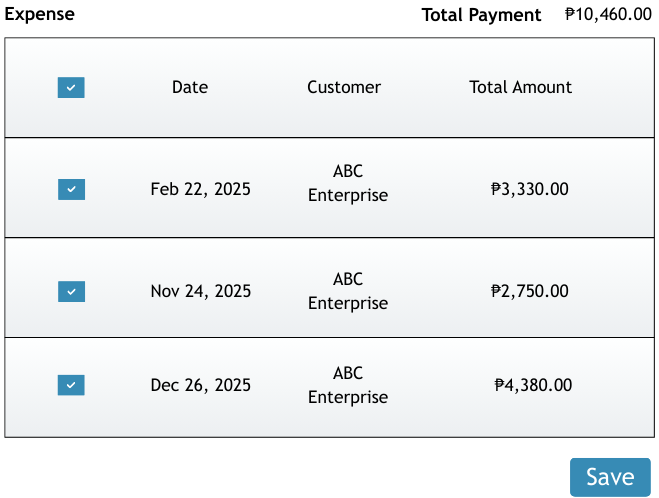

Batch Payment made simple

Settle many bills at once, log partial amounts properly, and see real-time vendor balances and due dates.

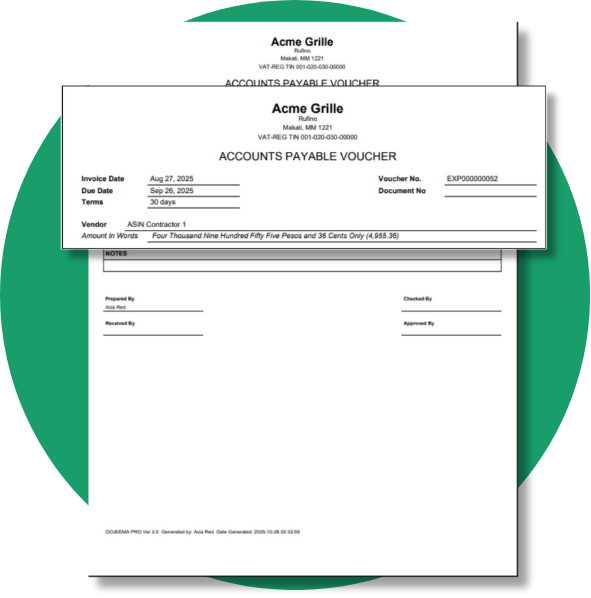

Professional Expense & Purchase Printouts

Generate clean printouts or save as PDF in seconds.

How does Oojeema help PH MSMEs pay suppliers on time?

How does Oojeema help PH MSMEs pay suppliers on time?

- Create bills in minutes

- Fast 2307 printing

- Import & export data in a snap

- BIR-ready reports in a click

- Batch Payment made simple

Trusted by Filipino businesses since 2014

MADE FOR FILIPINOS. BY FILIPINOS.

AL Jeff Abellar Salmete

G & B Seafood Trading

“We switched to using Oojeema because we find that Oojeema is very easy to navigate and caan be used online/anywhere. They also have an excellent customer service.”

Claire Fernandez

CAM Industrial Sourcing

“In 2019, with the increase in our sales volume, we thought of hiring a bookkeeper or switch to an accounting software.

A friend recommended Oojeema to us. It is user friendly. And of course, I saved on hiring a new personnel.“

Philip Barcelon

Sycamore Business Solutions, Inc.

“We have been using Oojeema since 2016 because it’s easy to use, easy to set-up, and accessible via the web regardless if we are using an IOS or Android device and all the leading browsers. Oojeema also listens & work on what the users need.”

Plans That Fit Your Business—And Your Tax Deadlines

UNLIMITED USERS included so you can invite your whole team with role-based access.

LITE

490

₱

per month

For Starting MSMEs

- Up to 8 transactions/month

- Core reports + cash view

- BIR forms + DAT exports

PRO

Most Popular

1,120

₱

per month

Best for Growing Teams

- Unlimited transactions

- Everything in Lite included

- Faster month-end workflow

PREMIUM

2,800

₱

per month

Inventory features included

- Inventory + COGS tracking

- Stock movement + adjustments

- Returns supported

Got questions?

We’ve got the answers.

What BIR Reports or Forms are supported?

– All the books of accounts:

Sales Journal, Purchase Journal, Cash Receipt Journal, Cash Disbursement Journal, General Ledger, and General Journal.

– SLS/SLP (Sales RELIEF and Purcahse RELIEF) including automated DAT file generation.

– 2551Q(Quarterly Percentage Tax Return).

– 0619E(Monthly Remittance Return of Expanded Creditable Tax Withheld).

– 1601EQ (Quarterly Remittance Return of Expanded Creditable Income Taxes Withheld).

– 1604E (Annual Information Return of Expanded Creditable Income Taxes Withheld/Income Payments Exempt from Withholding Tax).

– Quarterly Alphalist of Payees (QAP).

– Summary Alphalist of Withholding Tax (SAWT).

Is this a Cloud-based software?

Do you offer free trials?

Yes, you can sign up for a free 14-day trial account by click on the try now or sign-up buttons.

Do you have demos or tutorials I can use?

For our User Guides, you can visit https://resources.oojeema.com

What's the difference between the Pro and Premium plans?

You can check out the comparison between Pro and Premium by visiting https://www.oojeema.com/pricing

Is Oojeema EOPT-Compliant?

Yes, Oojeema has been updated to comply with the EOPT Law. You can read about the specific EOPT update here.