BIR Compliance Made Simple

Generate Philippine-ready reports and forms from your actual transactions so filing is clear and on time.

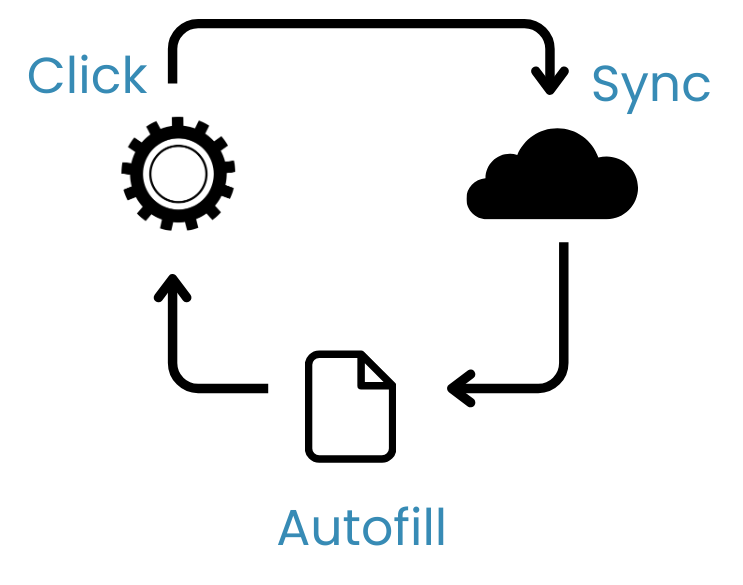

Powered by Our 3-Layer Smart Filing System

Click-to-File Automation

Record your sales, purchases, and expenses as you go—once, in one place.

BIRSync Engine

Then Oojeema uses that same data to generate your books of accounts, financial reports, BIR forms, and DAT files.

Smart Tax Field Autofill

When it’s time to file, you simply review, export, and upload—without retyping.

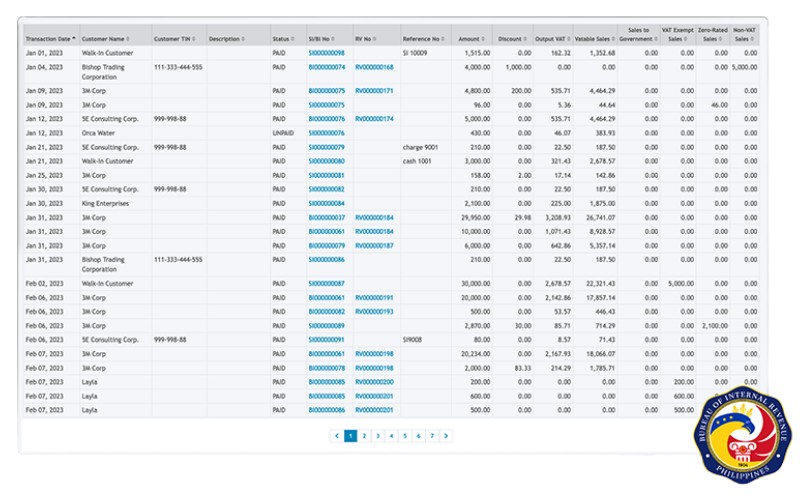

Turn transactions into BIR-ready outputs

Financial Statements

See your position and performance with clear, up-to-date statements.

- Balance Sheet

- Income Statement

- Trial Balance

- General Ledger

- General Journal

- Statement of Account

- Accounts Receivable Aging

- Accounts Payable Aging

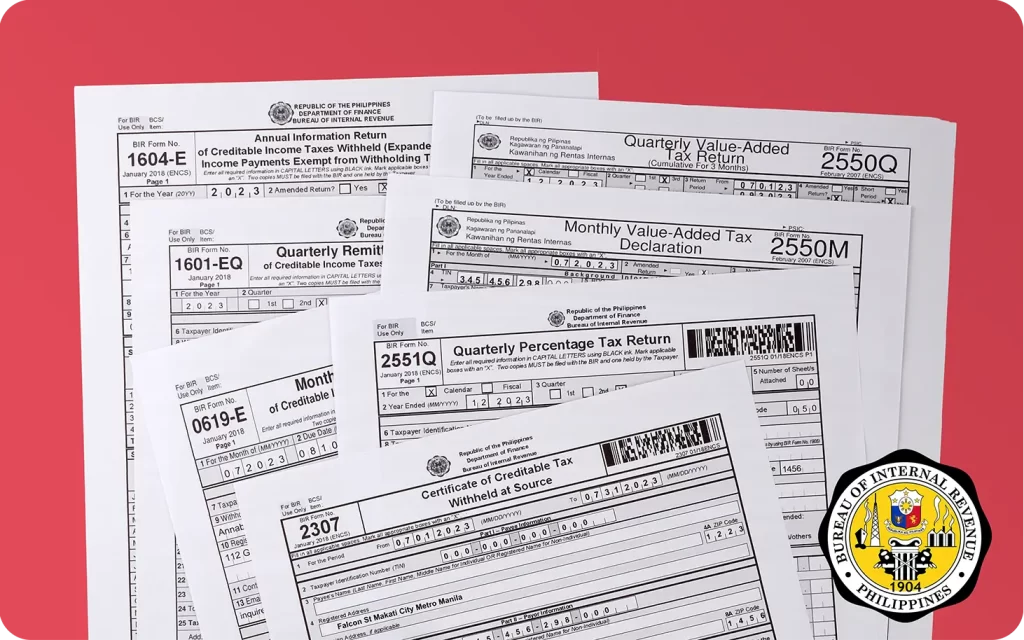

Tax Reports

Produce BIR-ready forms in the correct Philippine formats.

- Books of Accounts

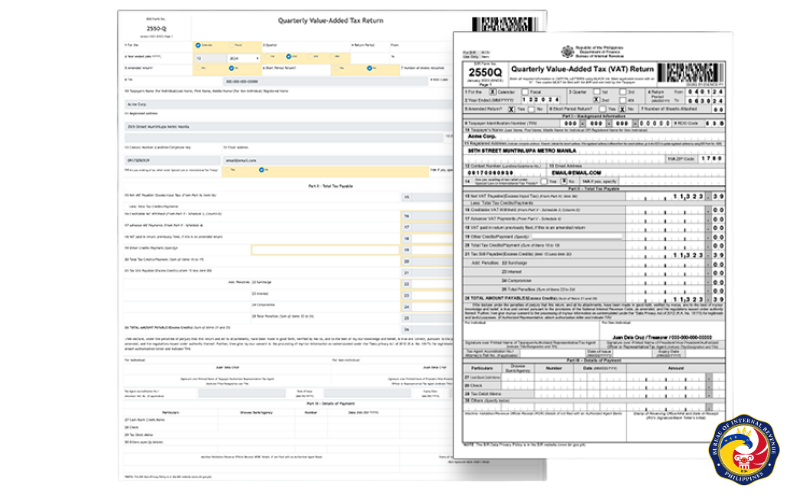

- VAT: 2550M or 2550Q

- Quarterly Expanded Withholding Tax: 1601EQ

- Annual Expanded Withholding tax: 1604E

- Monthly Expanded withholding Tax:0619E

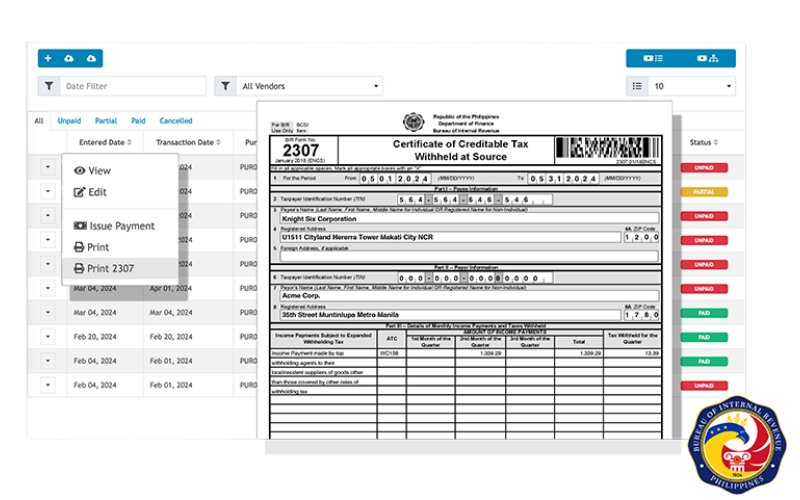

Certificate of Creditable Tax Withheld: 2307 (print-ready)

Turn posted payments into a clean Form 2307 that is ready to print and share.

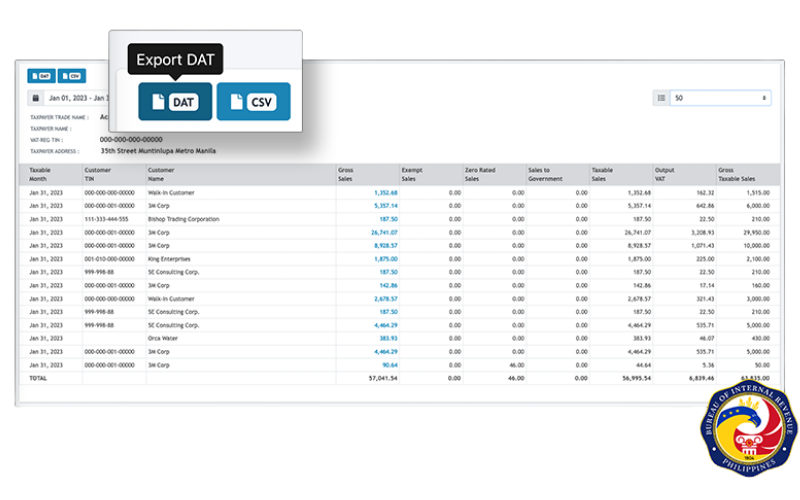

Listings and DAT exports

Export SLS, SLP, SAWT, and QAP in DAT format for easy e-submission.

File BIR Forms With Confidence

Oojeema helps Philippine business owners by turning everyday sales and expenses into accurate, BIR-ready forms you can review in one place—with clear tax totals before filing, no retyping across reports, formats aligned to PH rules, and free accountant access—so you file on time, avoid costly errors, and stay focused on running the business.

Already a Oojeema user and need help Generating BIR Forms?

Watch our 1-min BIR Form guide

Trusted by Filipino businesses since 2014

MADE FOR FILIPINOS. BY FILIPINOS.

AL Jeff Abellar Salmete

G & B Seafood Trading

“We switched to using Oojeema because we find that Oojeema is very easy to navigate and caan be used online/anywhere. They also have an excellent customer service.”

Claire Fernandez

CAM Industrial Sourcing

“In 2019, with the increase in our sales volume, we thought of hiring a bookkeeper or switch to an accounting software.

A friend recommended Oojeema to us. It is user friendly. And of course, I saved on hiring a new personnel.“

Philip Barcelon

Sycamore Business Solutions, Inc.

“We have been using Oojeema since 2016 because it’s easy to use, easy to set-up, and accessible via the web regardless if we are using an IOS or Android device and all the leading browsers. Oojeema also listens & work on what the users need.”

Plans That Fit Your Business—And Your Tax Deadlines

UNLIMITED USERS included so you can invite your whole team with role-based access.

LITE

490

₱

per month

For Starting MSMEs

- Up to 8 transactions/month

- Core reports + cash view

- BIR forms + DAT exports

PRO

Most Popular

1,120

₱

per month

Best for Growing Teams

- Unlimited transactions

- Everything in Lite included

- Faster month-end workflow

PREMIUM

2,800

₱

per month

Inventory features included

- Inventory + COGS tracking

- Stock movement + adjustments

- Returns supported

Got questions?

We’ve got the answers.

What BIR Reports or Forms are supported?

– All the books of accounts:

Sales Journal, Purchase Journal, Cash Receipt Journal, Cash Disbursement Journal, General Ledger, and General Journal.

– SLS/SLP (Sales RELIEF and Purcahse RELIEF) including automated DAT file generation.

– 2551Q(Quarterly Percentage Tax Return).

– 0619E(Monthly Remittance Return of Expanded Creditable Tax Withheld).

– 1601EQ (Quarterly Remittance Return of Expanded Creditable Income Taxes Withheld).

– 1604E (Annual Information Return of Expanded Creditable Income Taxes Withheld/Income Payments Exempt from Withholding Tax).

– Quarterly Alphalist of Payees (QAP).

– Summary Alphalist of Withholding Tax (SAWT).

Is this a Cloud-based software?

Do you offer free trials?

Yes, you can sign up for a free 14-day trial account by click on the try now or sign-up buttons.

Do you have demos or tutorials I can use?

For our User Guides, you can visit https://resources.oojeema.com

What's the difference between the Pro and Premium plans?

You can check out the comparison between Pro and Premium by visiting https://www.oojeema.com/pricing

Is Oojeema EOPT-Compliant?

Yes, Oojeema has been updated to comply with the EOPT Law. You can read about the specific EOPT update here.