Reconcile in Minutes

Import your statement, tag and match transactions, and finalize with confidence—built for Philippine SMEs and accountants

How it Works

Oojeema’s Bank Reconciliation helps you match your bank statement to your books quickly. Import your statement, tag and match transactions, and finalize with confidence—no complex setup, no spreadsheets.

Import

Paste your bank export into our CSV and upload. Clean import, ready in minutes for tagging, matching, and reconciliation.

Tag & Match

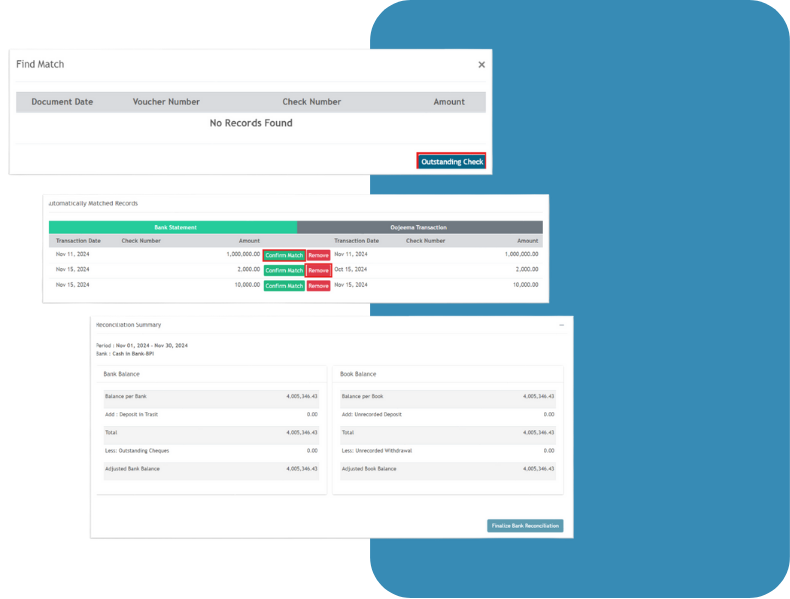

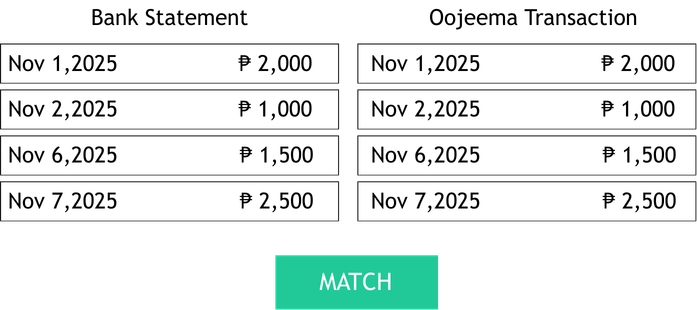

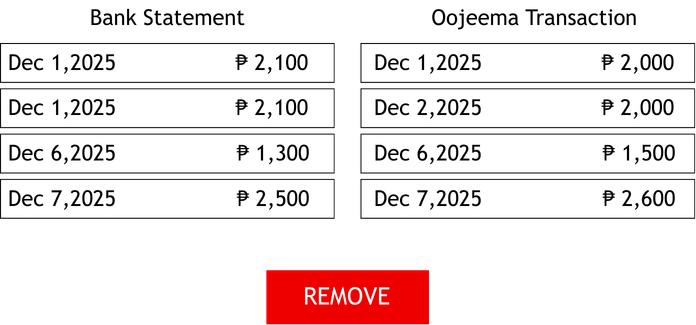

Tag and match each bank line in a few clicks. Split fees, merge entries, or adjust details while Auto-Matched clears the easy wins.

Finalize

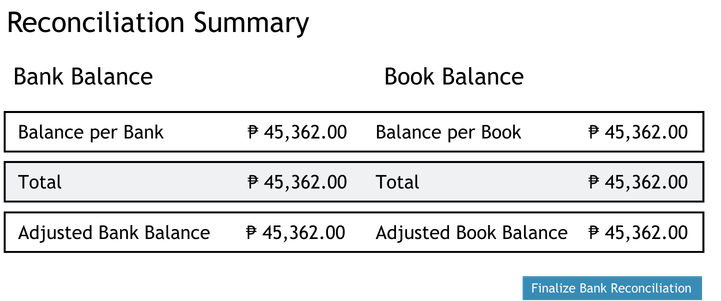

When the difference hits zero, finalize with a click. Your reconciliation is preserved with timestamps and users—ready for review anytime

A smarter way to do Bank Reconciliation

See your true cash today

Compare your bank statement with your books to know exactly how much cash you can use—no guesswork.

Match deposits and expenses faster

Import your bank statement and use Tag & Match plus Automatically Matched Records to clear items in minutes.

Prevent fraud and errors

Unusual withdrawals or unfamiliar transactions stand out when you reconcile regularly.

Cleaner books, smoother closes

Reconciled cash means your journals, GL, TB, IS/BS are accurate and ready for month-end.

Catch Duplicates & Missed Entries

Spot unrecorded bank charges, interest income, NSF/returned checks, or duplicate postings before they snowball.

Speed up collections

Identify customer payments that hit the bank but aren’t tagged to invoices yet, so you can apply them and follow up on real overdue items.

How does Oojeema Bank Reconciliation help PH MSMEs ?

For Philippine businesses, Oojeema Bank Recon shows your true cash today by auto-matching Bank deposits, surfacing missing payments, and prompting same-day follow-ups—so you collect faster and make confident release and payout decisions.

Trusted by Filipino businesses since 2014

MADE FOR FILIPINOS. BY FILIPINOS.

AL Jeff Abellar Salmete

G & B Seafood Trading

“We switched to using Oojeema because we find that Oojeema is very easy to navigate and caan be used online/anywhere. They also have an excellent customer service.”

Claire Fernandez

CAM Industrial Sourcing

“In 2019, with the increase in our sales volume, we thought of hiring a bookkeeper or switch to an accounting software.

A friend recommended Oojeema to us. It is user friendly. And of course, I saved on hiring a new personnel.“

Philip Barcelon

Sycamore Business Solutions, Inc.

“We have been using Oojeema since 2016 because it’s easy to use, easy to set-up, and accessible via the web regardless if we are using an IOS or Android device and all the leading browsers. Oojeema also listens & work on what the users need.”

Plans That Fit Your Business—And Your Tax Deadlines

UNLIMITED USERS included so you can invite your whole team with role-based access.

LITE

490

₱

per month

For Starting MSMEs

- Up to 8 transactions/month

- Core reports + cash view

- BIR forms + DAT exports

PRO

Most Popular

1,120

₱

per month

Best for Growing Teams

- Unlimited transactions

- Everything in Lite included

- Faster month-end workflow

PREMIUM

2,800

₱

per month

Inventory features included

- Inventory + COGS tracking

- Stock movement + adjustments

- Returns supported

Got questions?

We’ve got the answers.

What BIR Reports or Forms are supported?

– All the books of accounts:

Sales Journal, Purchase Journal, Cash Receipt Journal, Cash Disbursement Journal, General Ledger, and General Journal.

– SLS/SLP (Sales RELIEF and Purcahse RELIEF) including automated DAT file generation.

– 2551Q(Quarterly Percentage Tax Return).

– 0619E(Monthly Remittance Return of Expanded Creditable Tax Withheld).

– 1601EQ (Quarterly Remittance Return of Expanded Creditable Income Taxes Withheld).

– 1604E (Annual Information Return of Expanded Creditable Income Taxes Withheld/Income Payments Exempt from Withholding Tax).

– Quarterly Alphalist of Payees (QAP).

– Summary Alphalist of Withholding Tax (SAWT).

Is this a Cloud-based software?

Do you offer free trials?

Yes, you can sign up for a free 14-day trial account by click on the try now or sign-up buttons.

Do you have demos or tutorials I can use?

For our User Guides, you can visit https://resources.oojeema.com

What's the difference between the Pro and Premium plans?

You can check out the comparison between Pro and Premium by visiting https://www.oojeema.com/pricing

Is Oojeema EOPT-Compliant?

Yes, Oojeema has been updated to comply with the EOPT Law. You can read about the specific EOPT update here.